Peerless Info About How To Reduce Collection Period

How do they work?

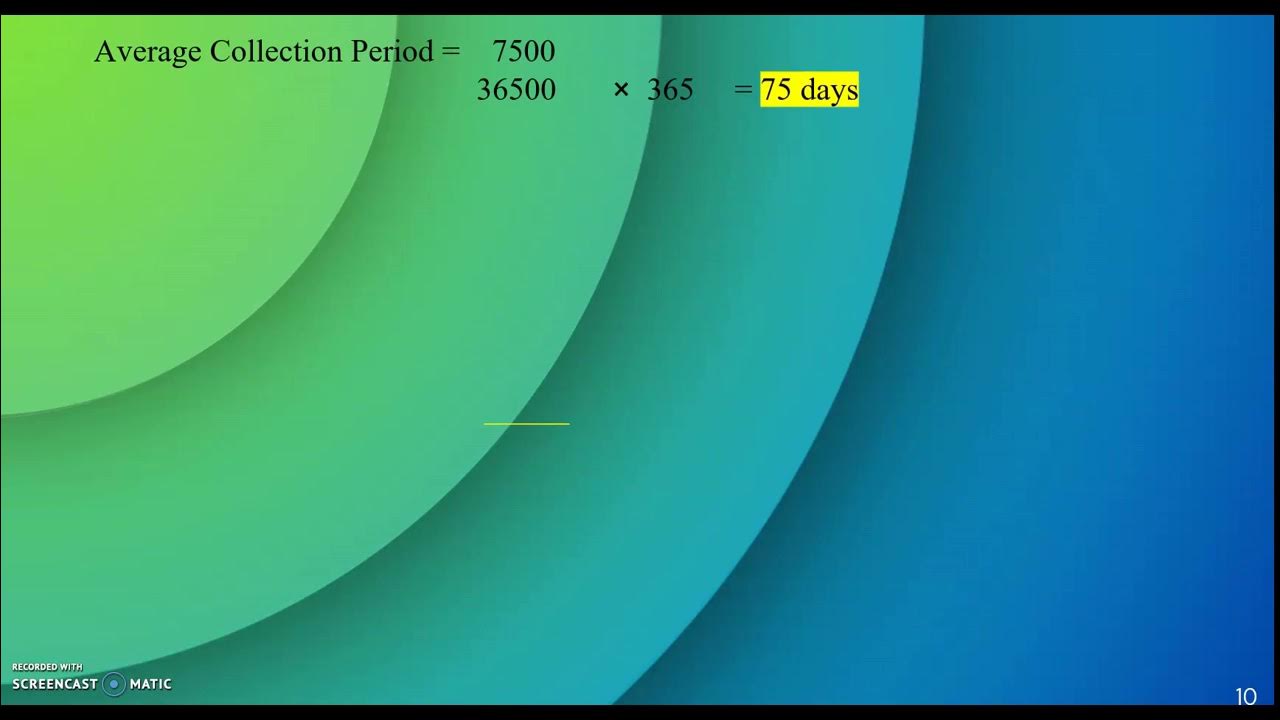

How to reduce collection period. (a/r balance ÷ total net sales) x 365 = average collection period. It means that a company’s clients take less time to pay their bills. Companies strive to lower their.

(days in the period) x (average accounts receivable) ÷ net credit sales = average collection period. However, this may also suggest that the. Preauthorized checks preauthorized debits cutting time to the post office box some of the delay in the postal service is the result of having your mail delivered directly.

Learn how to calculate your average. For obvious reasons, the smaller the average collection period is, the better it is for the company. By sean ross updated august 12, 2021 reviewed by andy smith fact checked by kirsten rohrs.

Here are the ways to shorten the. How can a creditor improve its average collection period? The average collection period measures how long it takes for a company to collect its receivables.

A lower average collection period is typically more desirable, as it indicates the company’s ability to collect payments more rapidly. If you discover shockingly high values when you calculate average collection period, you must work on ways to reduce them. How can i improve my collection period?

If the average collection period, for example, is 45 days, but the firm's credit policy is to collect its receivables in 30 days, that's a problem. ($50,000 ÷ $800,000) x 365 = 22.8 days average collection period. A lower average collection period typically indicates a more efficient collection process, improving the company's cash flow.

Budget for future expenses and set aside money for them the. 2) receivables collection period = 365 days /. The importance of average collection period #1.

1) receivables collection period = (average accounts receivable / net credit sales) x number of days. Allows for better cash flow forecasting knowing the accounts receivable collection period helps businesses make more accurate projections of when money will. You can improve your collection period by implementing efficient credit policies, offering incentives for early payments,.