Casual Info About How To Obtain Letter Of Credit

What is a letter of credit and how is it used?

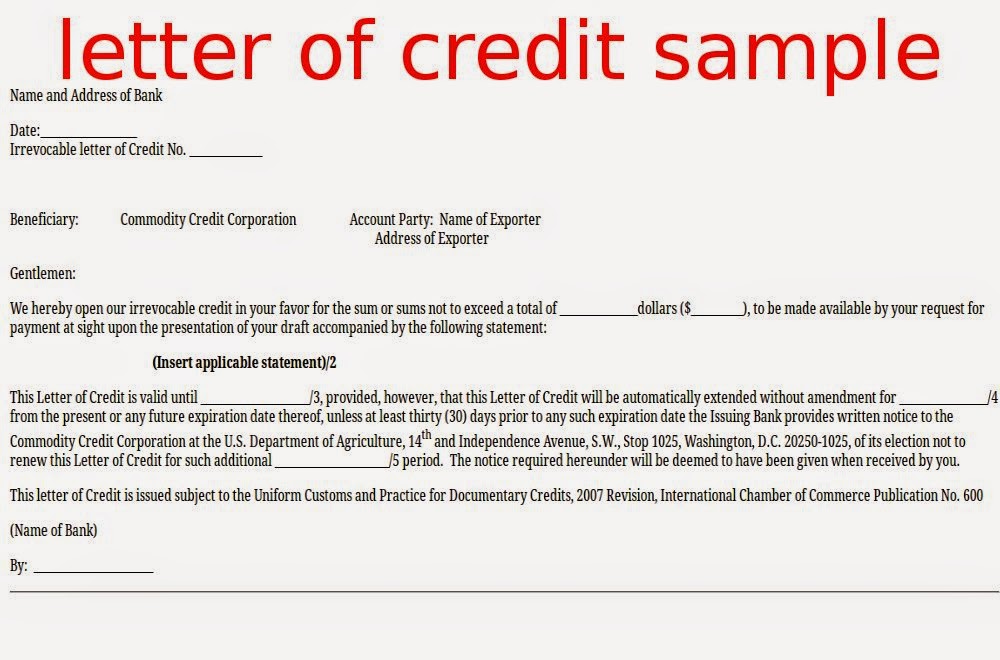

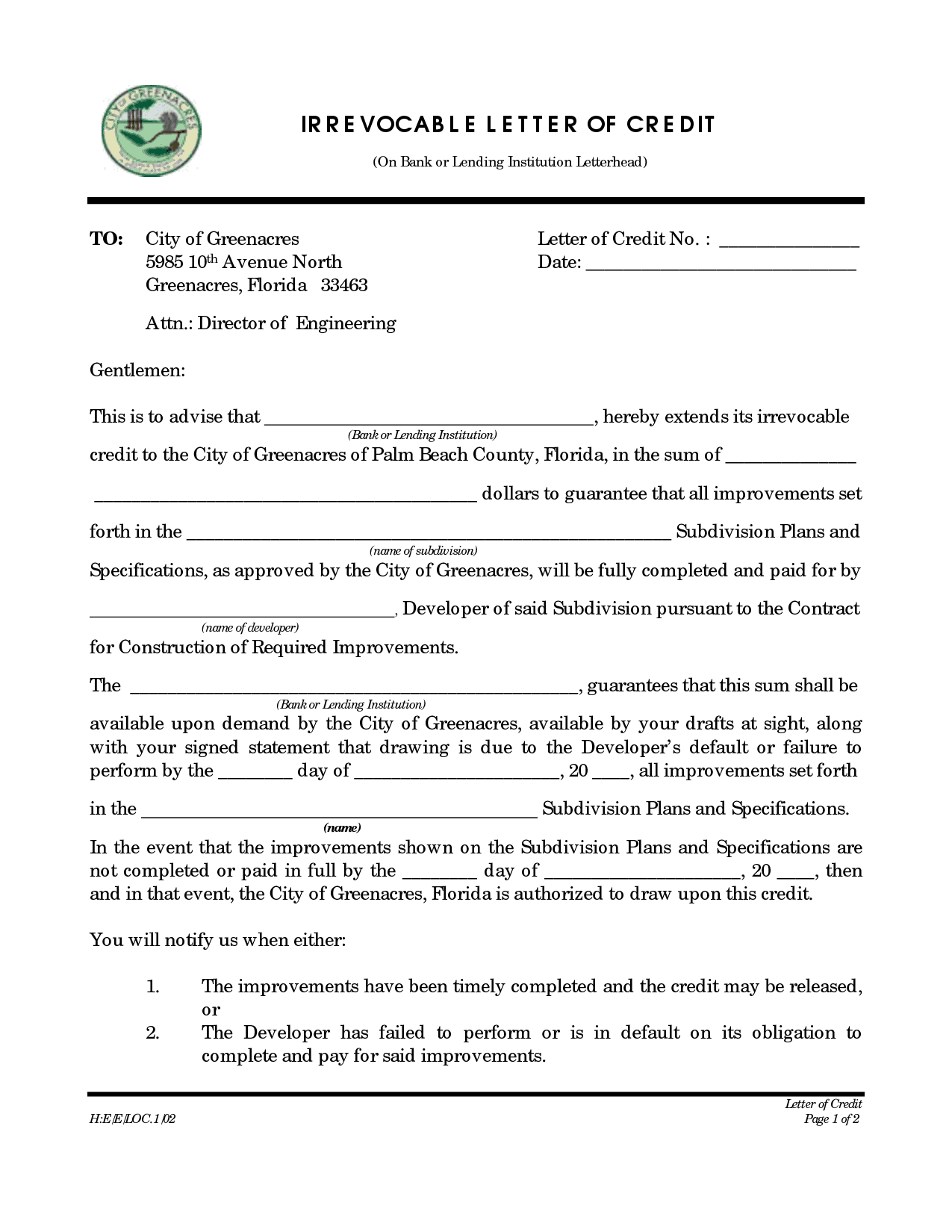

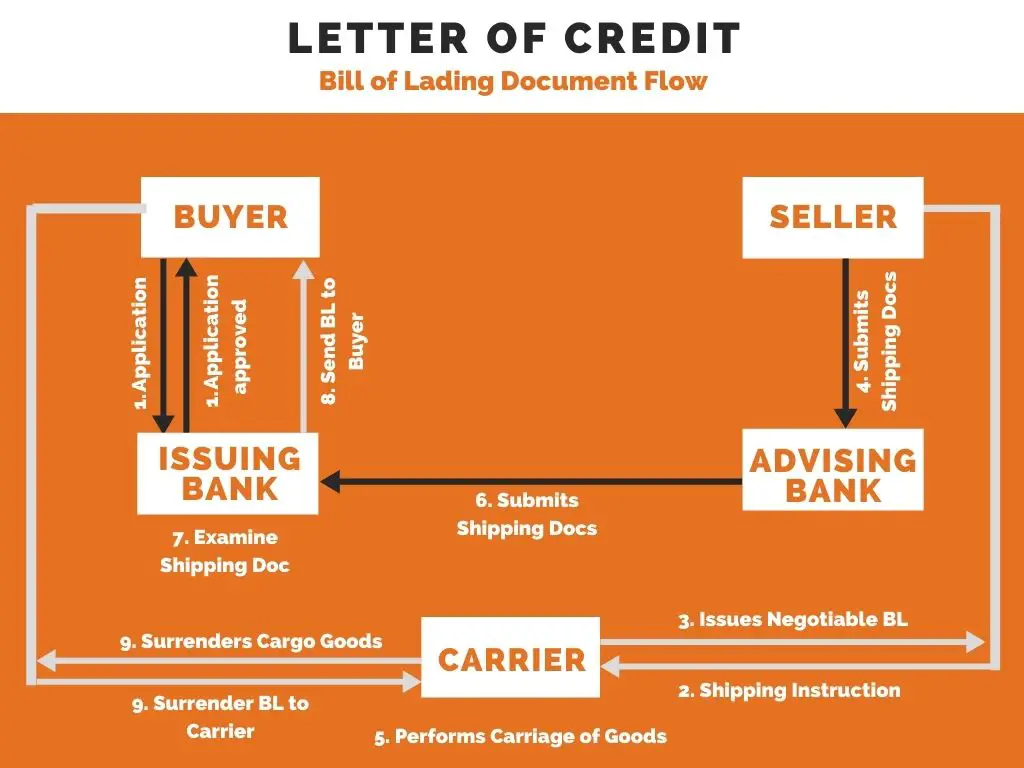

How to obtain letter of credit. The easiest way to understand how. A letter of credit, also referred to as a documentary credit, is a contractual agreement whereby the issuing bank (importer's bank), acting on behalf of the customer. An l/c is a document that states that.

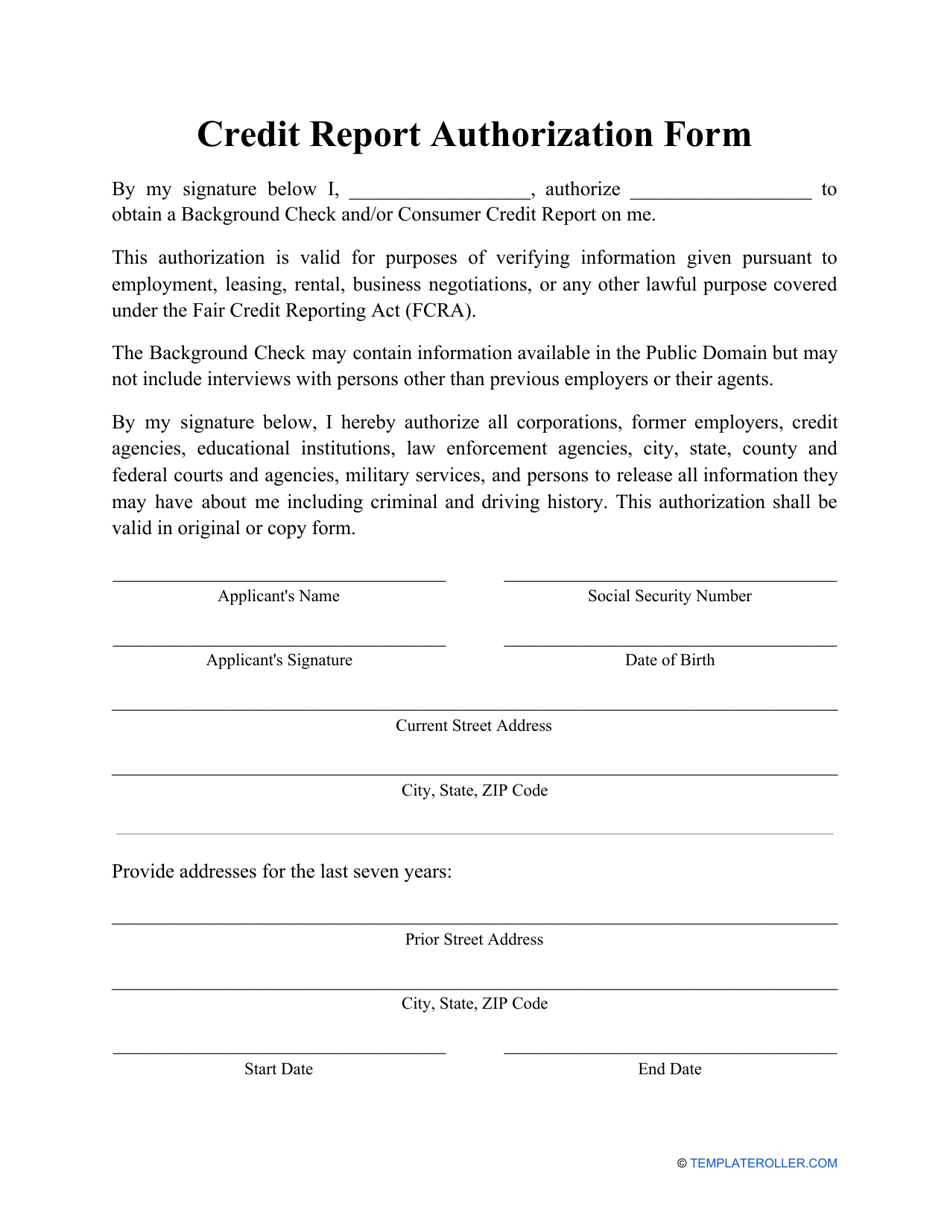

Definition of a standby letter of credit. A letter of credit facility is a contract between a buyer and seller where the bank guarantees payment upon presenting certain documents. The bank may ask for additional collateral if the risk.

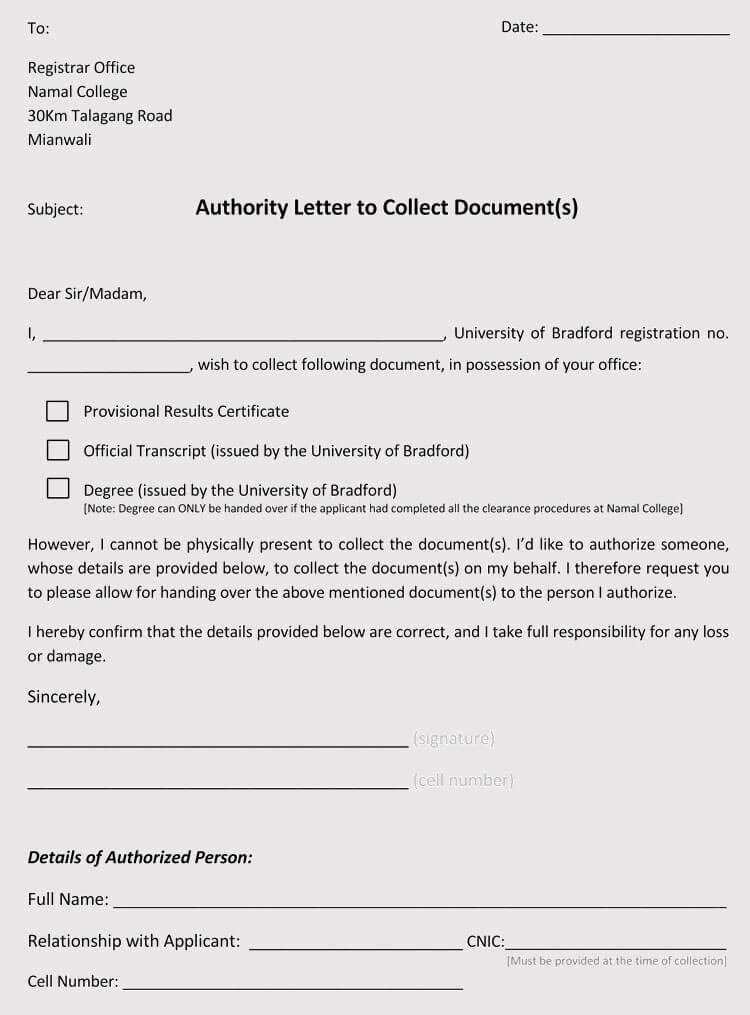

What is a letter of credit? Letter of credit? In order to obtain a standby letter of credit, a buyer has to contact a bank and establish their creditworthiness.

Definition of a letter of credit. Definition of a commercial letter of credit. To obtain a letter of credit from a bank, you should have an excellent credit history as a buyer and ideally a relationship with the bank as a customer.

A standby letter of credit is often required in international trade to help a business obtain a contract. What type and size of export transactions are suitable for a letter of credit? Updated on december 8, 2022.

How much does a letter of credit cost? Since the parties to the contract. What is a letter of credit?

A letter of credit (l/c) is a type of payment guarantee that is often used in international trade. Types of letters of credit. Standby letter of credit explained.

A letter of credit is a written. A letter of credit, or credit letter, is a bank guarantee that a specific payment. A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount.

A letter of credit facility. A letter of credit, also known as a credit letter, is a document from a bank or other financial institution guaranteeing that a specific payment will be made in a. A letter of credit (loc) is a promise from a bank to make a payment after verifying that somebody meets certain conditions.

If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.