Stunning Info About How To Manage Hedge Funds

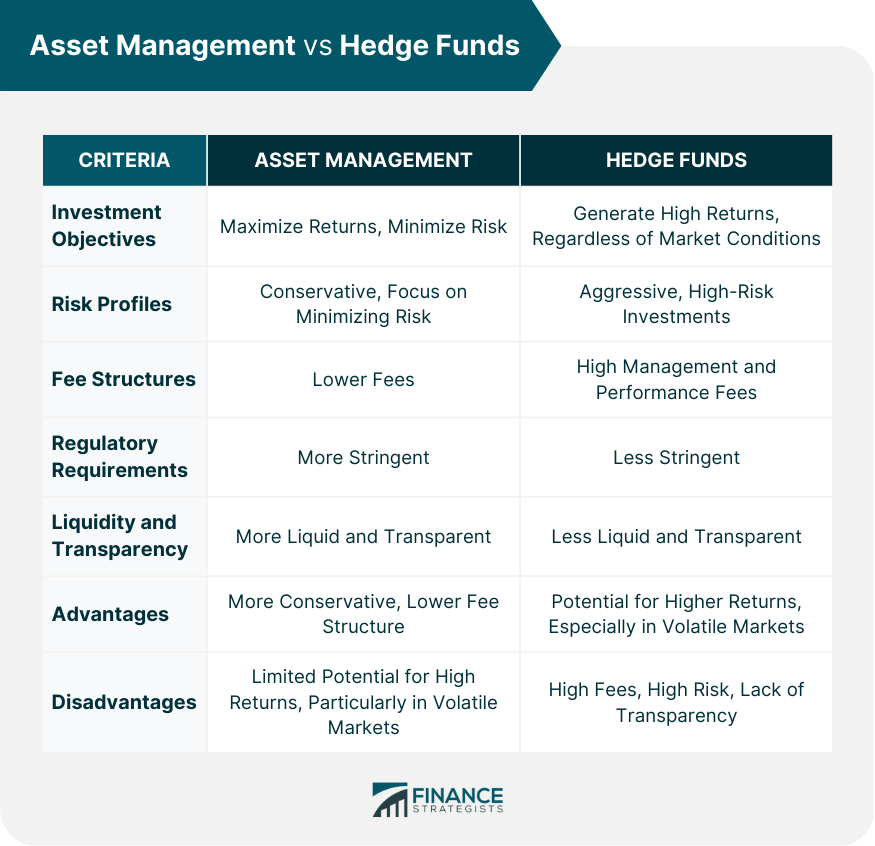

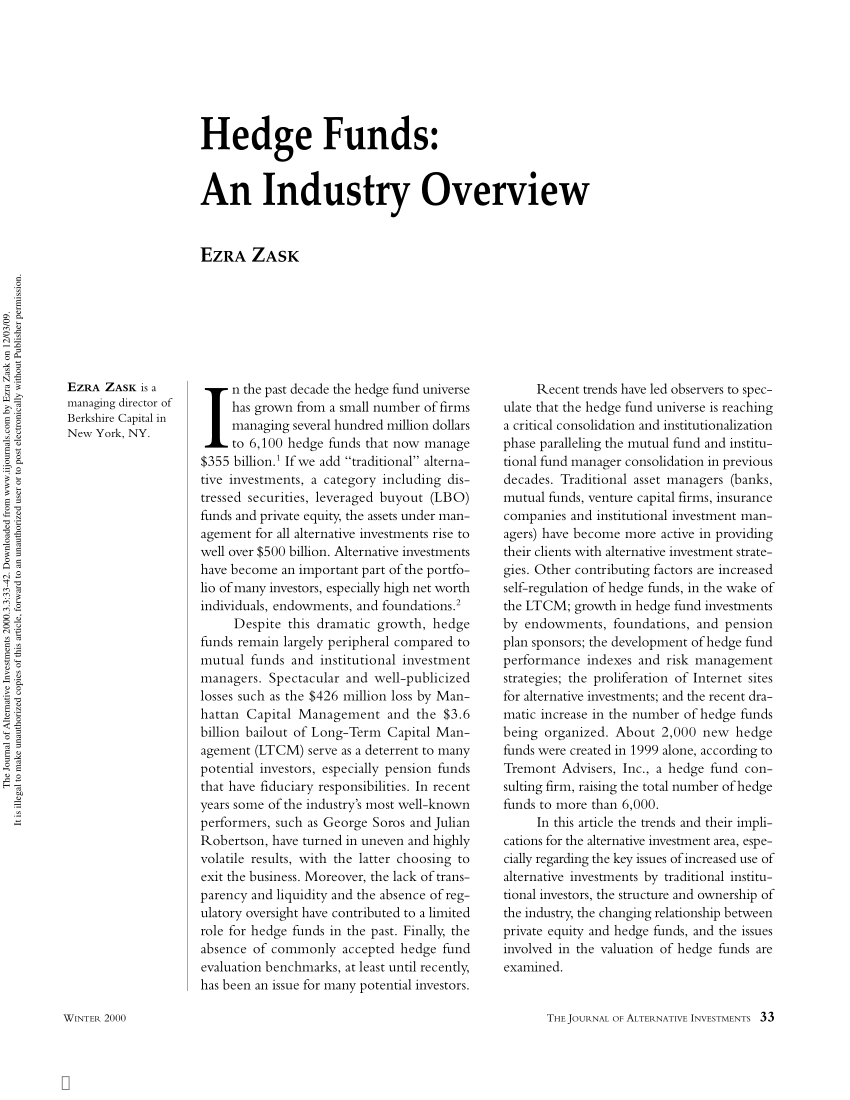

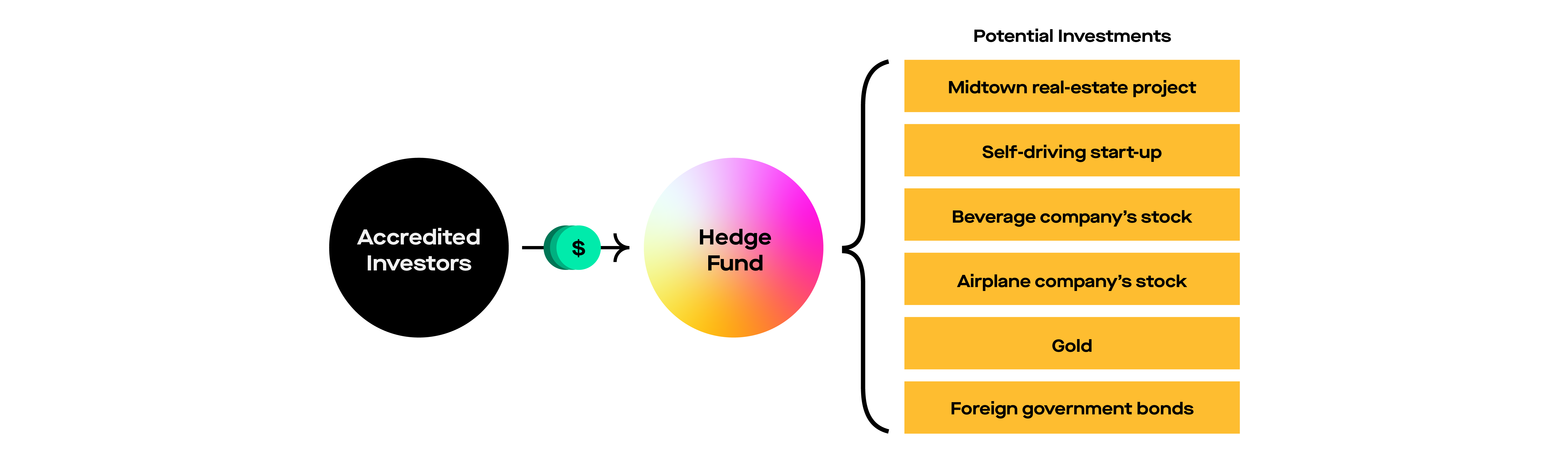

A hedge fund is a pooled investment vehicle that uses specialized hedging strategies across various asset classes to generate positive returns uncorrelated with the broader market.

How to manage hedge funds. This isn't like jumping into the stock or bond market. For the majority of investors, participating in a hedge fund will be difficult because.

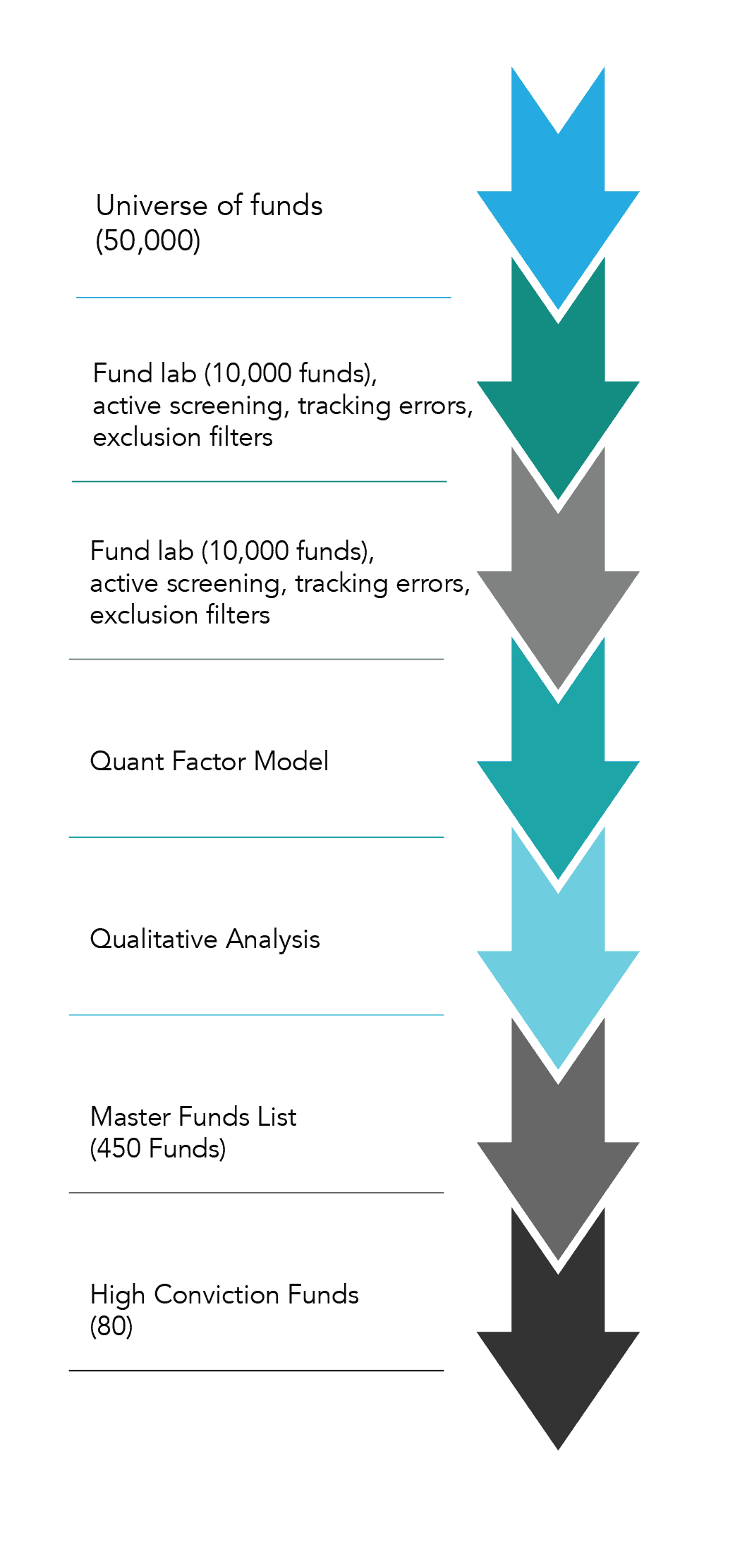

To be successful, a hedge fund manager must consider how to create and maintain a competitive advantage, a clearly defined investment strategy, adequate capitalization, a marketing and sales. Diversification, which requires building portfolios that contain a variety of asset types and risk profiles as a way to spread out risk and maximize potential returns.

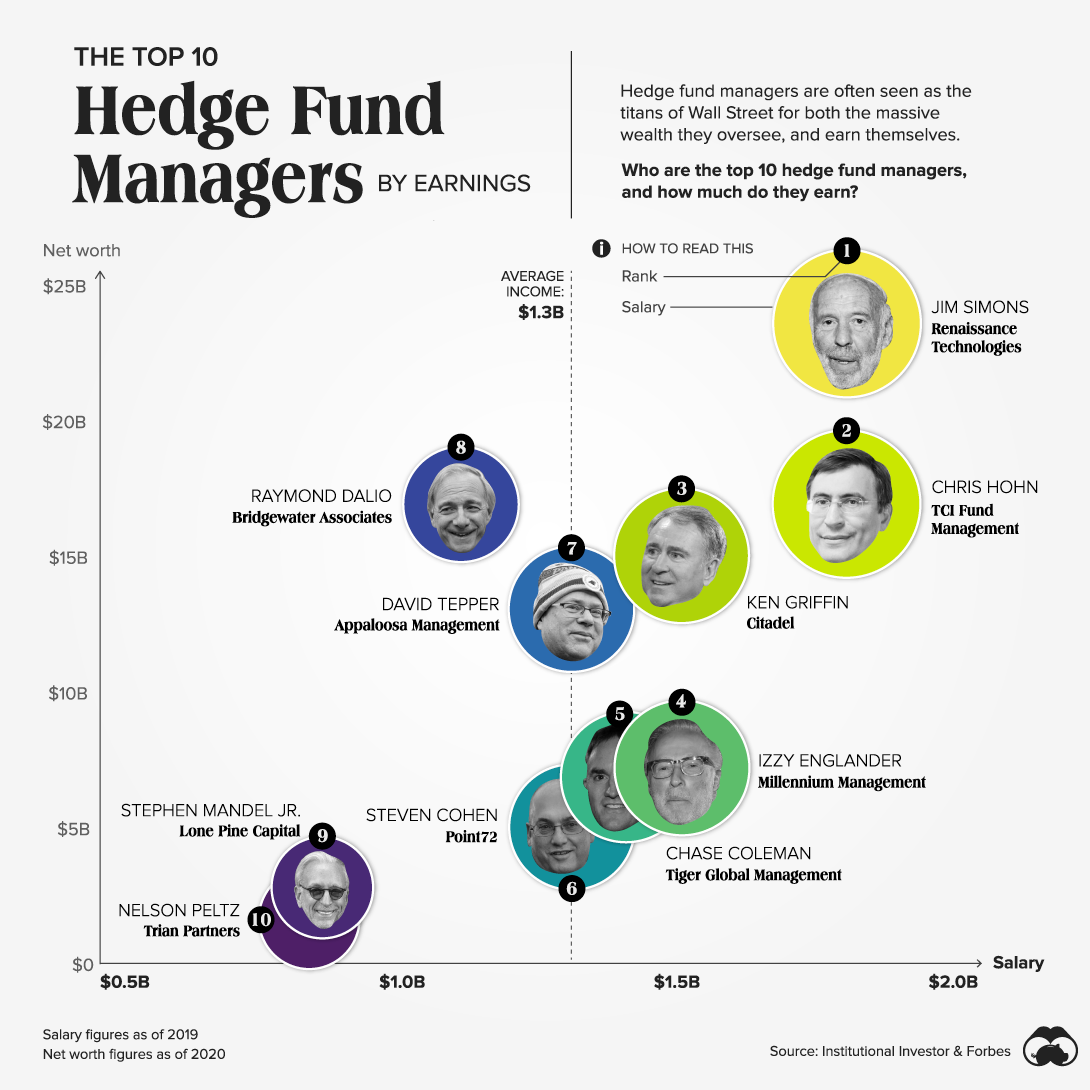

A hedge fund manager decides how pooled funds should be invested in order to meet certain objectives. First things first: Hedge fund managers can earn a high income through the fees they charge.

How to invest like a hedge fund. A hedge fund is an unregulated alternative investment vehicle that uses a wide selection of strategies and financial instruments (unavailable to regulated pooled funds) to achieve strong returns independent of market performance. Hedging, which aims to limit risk by offsetting one security’s risk with another.

Updated february 22, 2021. Selecting the right service providers. It can't rely on certain.

Hedge funds may invest in highly illiquid assets that can be difficult to value, according to the sec. Hedge fund managers can invest in many different types of markets, including stocks, bonds, and commodities, but they also employ complex. Hedge fund managers manage a pool of investments called hedge funds.

How to choose the right hedge fund for your investment goals. Tekmerion capital management is moving its macro hedge fund to brevan howard asset management ’s platform, where it will manage money for the firm as well as its own clients. What is a hedge fund?

Develop marketing and fundraising strategies. What is a hedge fund and how does it work? The hedge funds that changed the game billions of dollars have poured into multimanager firms in the past few years, but few have managed to match the success of citadel, millennium and point72.

Gain exposure to institutional hedge funds that may minimize risk for your clients' portfolios. Written by rebecca lake. Best practices for managing risk include, “trading limits, stress testing, liquidity analysis, backtesting, and an understanding of leverage.” use of tactics such as trading envelopes, stop losses, hedging, and buying put options.

Hedge funds are alternative investment funds. How to invest in hedge funds. Make sure the strategy is replicable and scalable.