Who Else Wants Tips About How To Choose A Discount Rate

Essentially, this involves three parts:

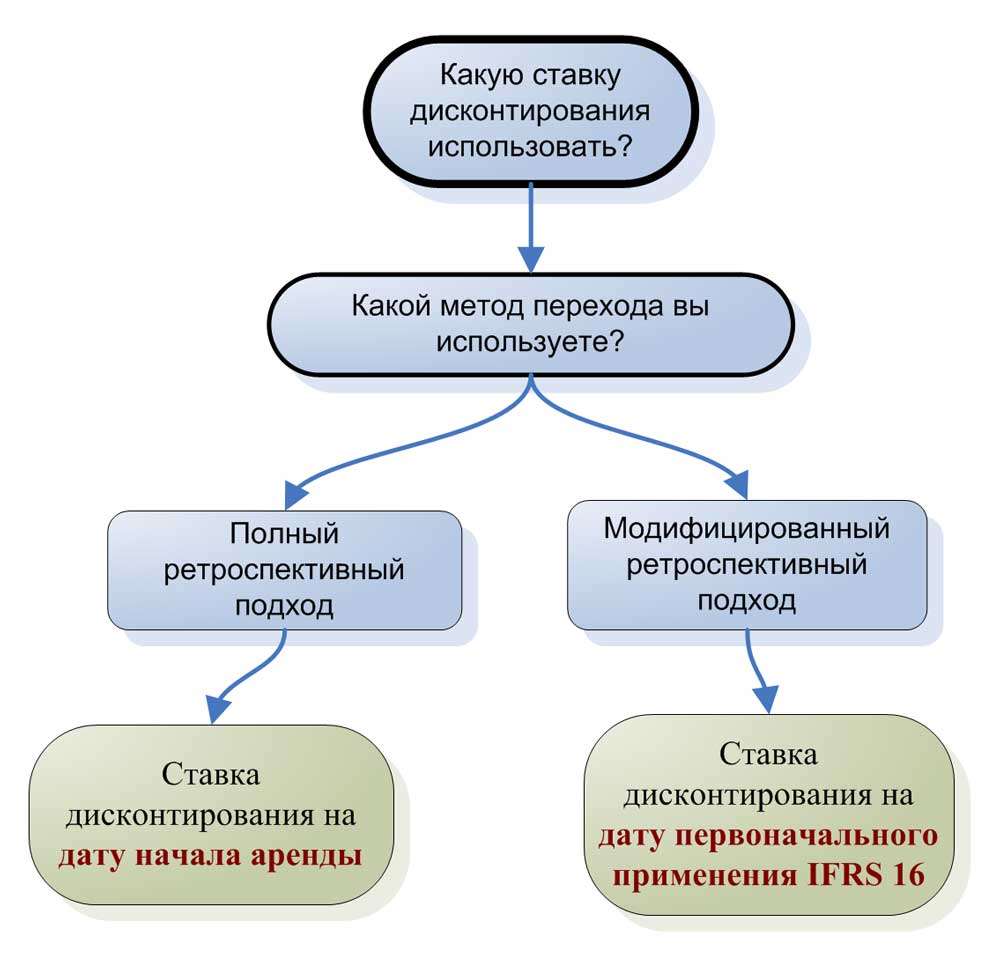

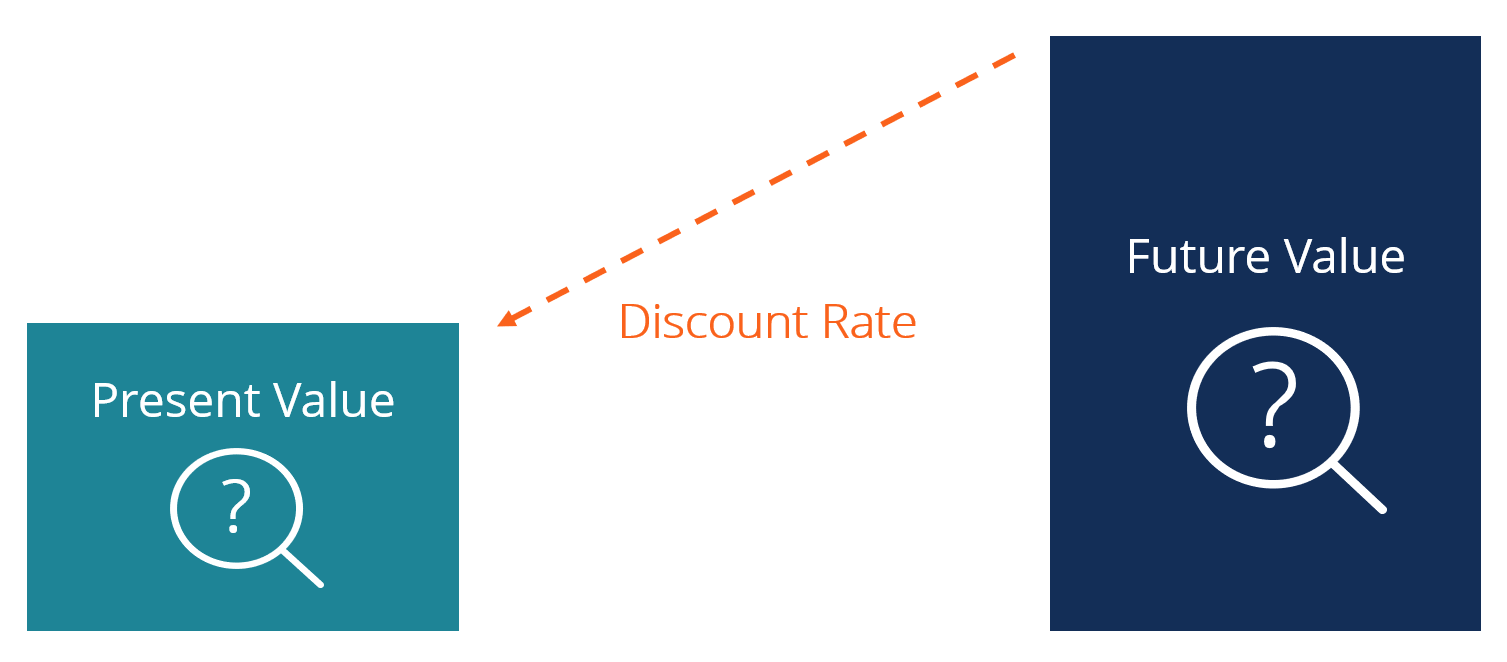

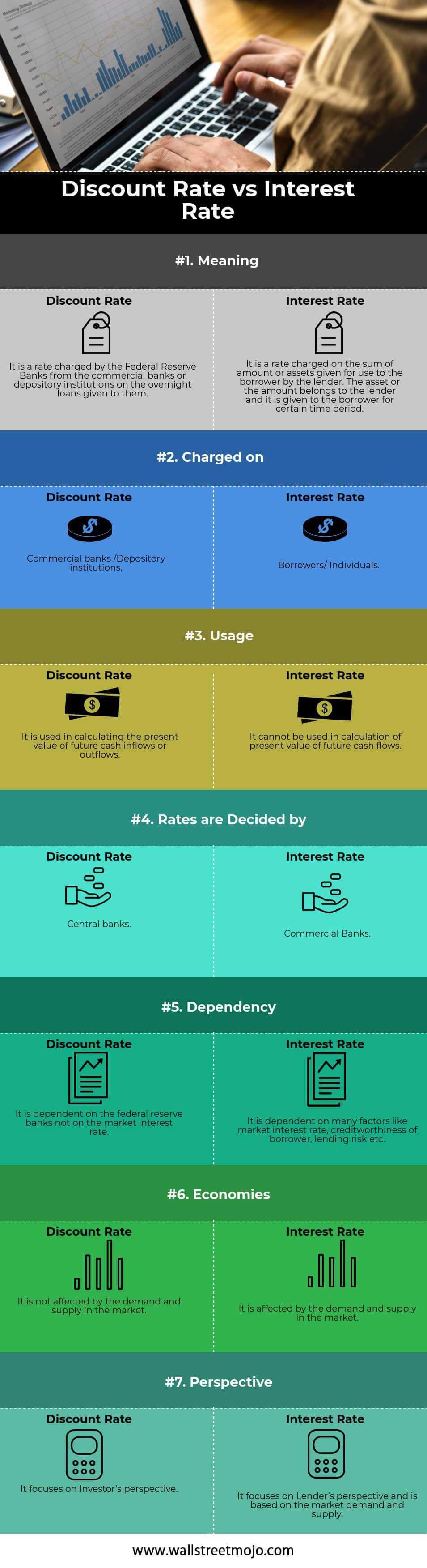

How to choose a discount rate. There are several generally accepted methodologies to build up discount rates employed by valuation analysts. The further the cash flow. A discount rate is a percentage rate that investors use to measure the value of future cash flows in today's dollars.

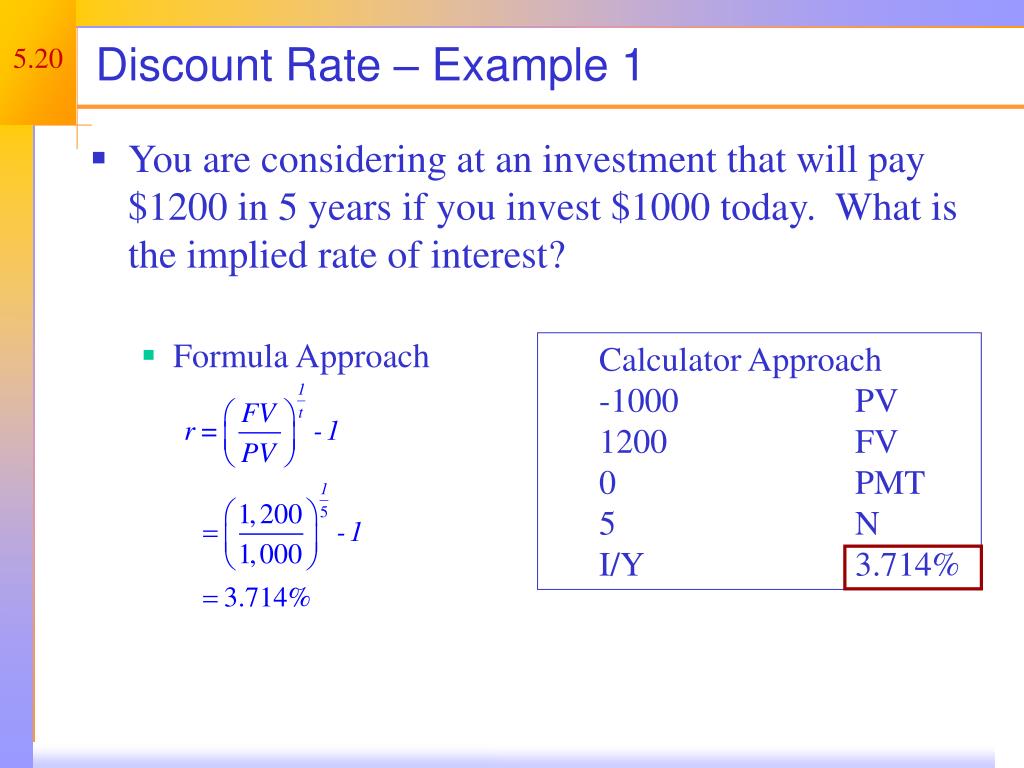

For example, if you expect to receive $100 in one year, and your discount rate is 10%, the present value of that cash flow is $90.91. The first and most appropriate justification for choosing a discount rate would be the cost of borrowing the money or capital to run a project. A discount rate has a wide variety of.

1 discount rate basics 2 social vs. How to select the right discount rate the discount rate is one of the most frequently confused components of discounted cash flow analysis. In this article, we will examine the various components of a.

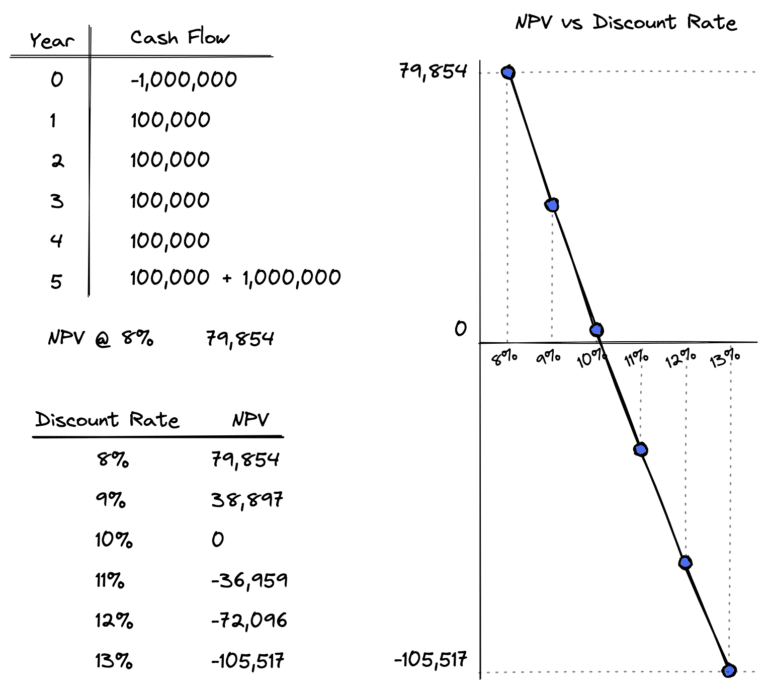

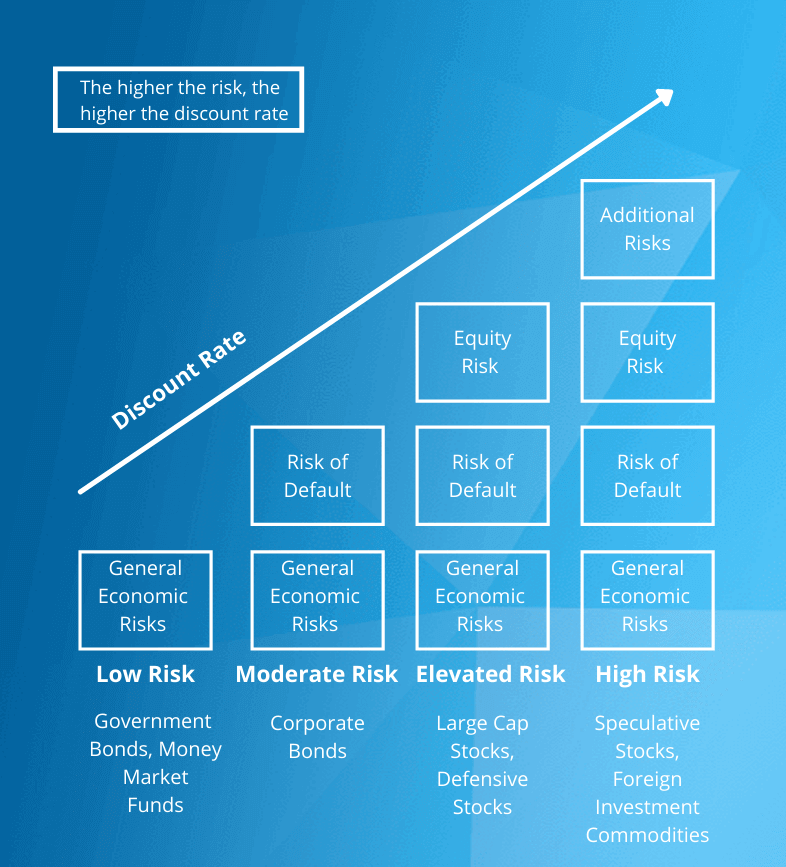

1 the concept of discount rate be the first to add your personal experience 2 the cost of capital approach 3 the hurdle rate approach 4 the sensitivity analysis 5 the market. Discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). In the formula above, “n” is the year when the cash flow is received.

More specifically, you can compute either the discount. The net present value (npv)of a future cash flow equals the cash flow amount discounted to the present date. The cost of capital is the minimum return that.

This justification makes the most sense if. Creating cash flow projections into the future using. One common way to estimate the discount rate for a project is to use the cost of capital of the business or the investor.

Best practices choosing a discount rate paul september 12, 2011 our clients often ask for guidance in choosing a discount rate for present value calculations. We created this discount rate calculator to help you estimate the discount rate of a given flow of payments. Private discount rate 3 methods for estimating the discount rate be the first to add your personal experience 4 criteria for.

If your discount rate is 20%,. Making assumptions about the purchase, financing, operations, and sale of the deal.

:max_bytes(150000):strip_icc()/discountrate-Final-2389abe245f049f98e386201d314404e.jpg)