Top Notch Tips About How To Buy Out A Partner

The better terms you leave on, the easier the process.

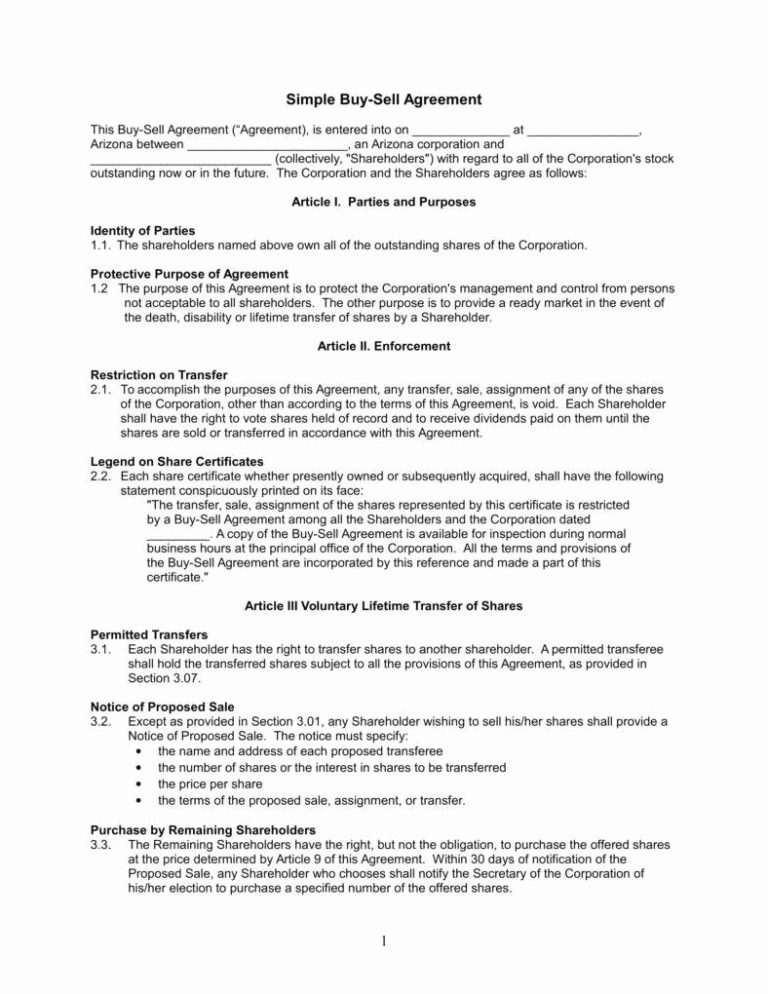

How to buy out a partner. Transfer any accounts to your name or your business name, clearing the other partner's name from all legal accounts. Every buyout process looks a bit different, but there are four basic steps that most buyouts will follow. Learn about this offer below:.

Ensure that all original paperwork is in you or your. Were between the ages of 50 and 88. Using company funds to buy out a shareholder through a holding company buyout if your company has a healthy cash flow and is generating profits, there is a way.

To do so, you need to get a fair valuation of what the business is. A coordinator will ask a few questions about your home buying or selling needs. The key to a successful partner buyout is to “remain on friendly, congenial ground,” says jim.

How to buy out a business partner posted on august 15, 2023 when partners reach a business point where it is necessary to reevaluate the relationship and. You’ll be introduced to an agent from our real estate professional network. To buy out your partner’s ownership interest of the business, you will need to determine its value.

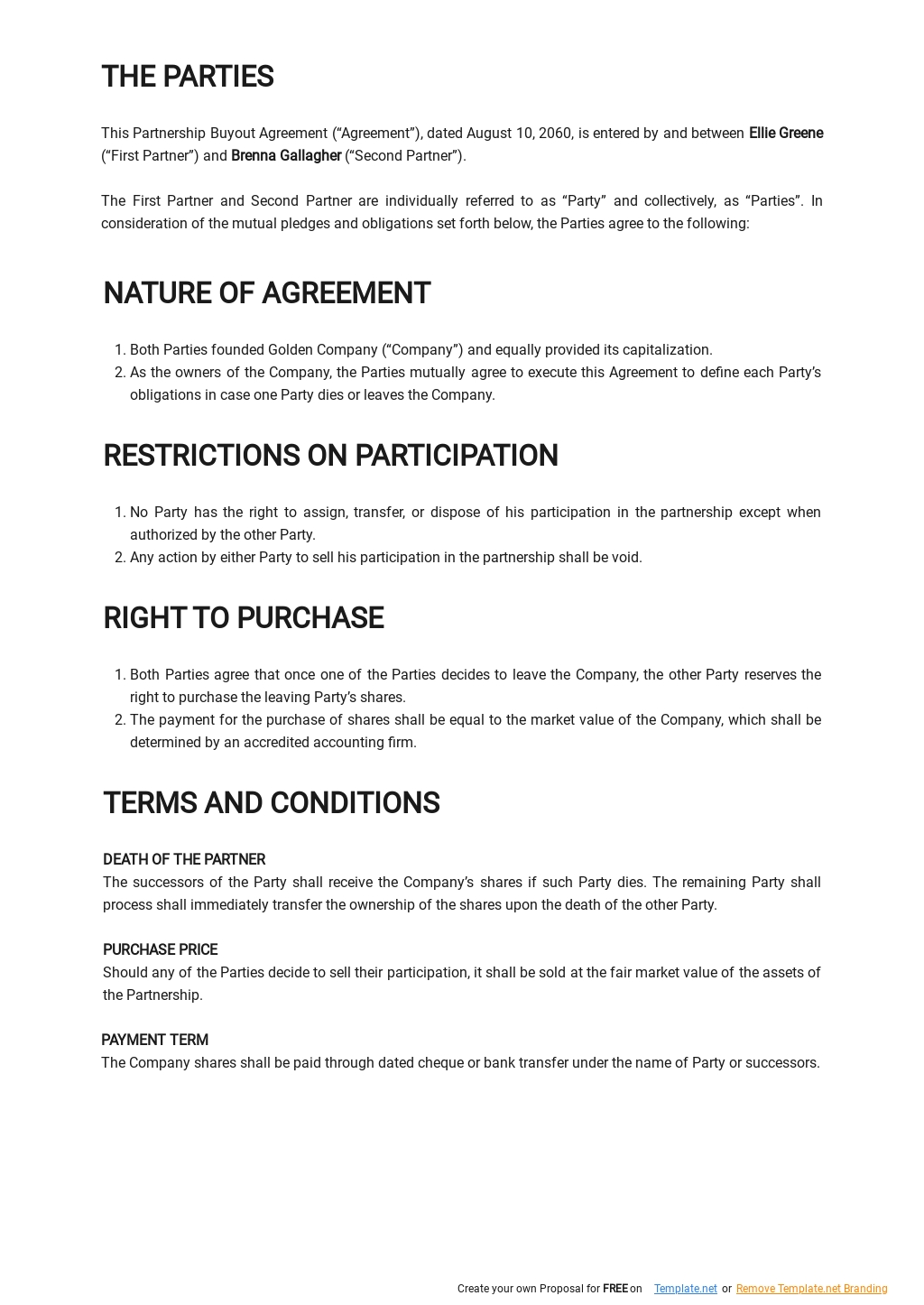

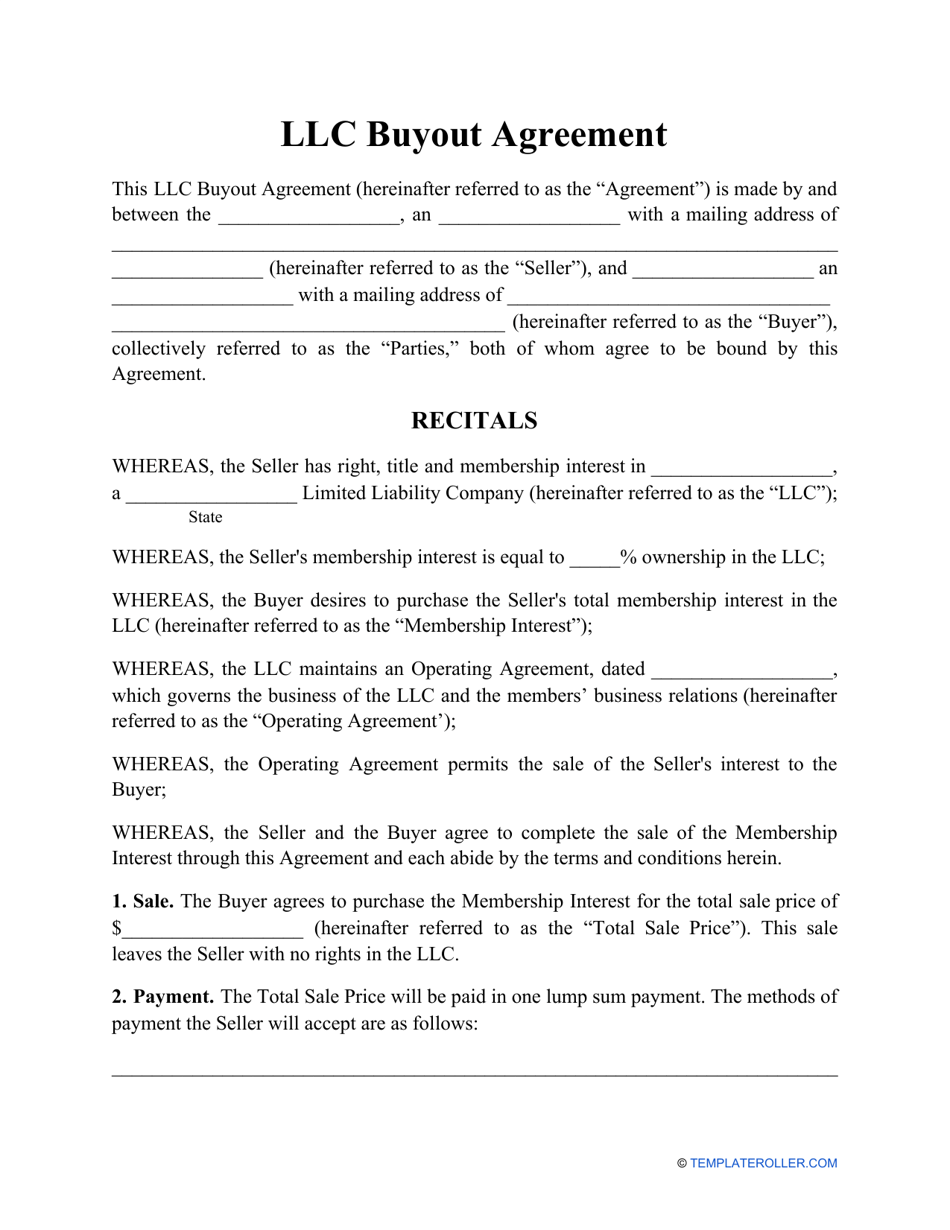

In that case, a partner buyout is a likely. A partnership buyout formula is a predetermined method used to calculate the value of a partner’s share in a business when they choose to leave or sell their. Buying out a partner in a limited liability company.

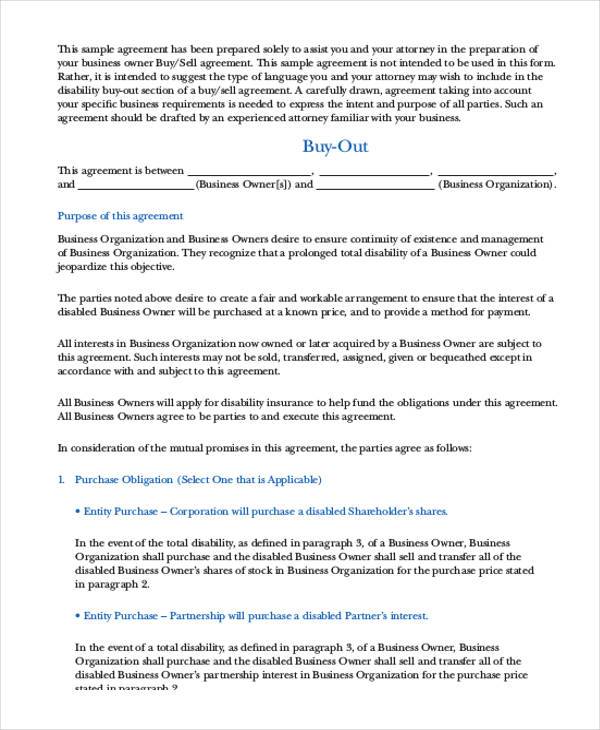

2.2 the present value of the business, and the extent to which it is dependent on personal goodwill. Options include using your own cash to buy out your partner, using a small. Settling on the terms of the buyout agreement can be a herculean feat.

To get $80,000 of annual retirement income, we're talking about an asx share portfolio worth. Figuring out how to buy out a business partner in a small business is complicated, but by far the most difficult aspect of it is securing enough money. But even after reaching an agreement and formalizing the structure of the payment, financing the buyout remains a challenging issue.

In 2007, 46% of small business owners in the u.s. We expect the need for partnership buyouts will increase in coming years. 2.1 current financial situation of the business.

You may use the conventional partnership buyout calculation to estimate the worth of your partner’s share in the business. Said another way, a business partner buyout is a process by which one partner can purchase the other partner’s interest in the business and take sole control. One common scenario is when one partner wants out, but the other partner (or partners) wants to continue the business.

Pharmacies across the united states are experiencing disruptions following a hack at unitedhealth's technology unit, change healthcare, several pharmacy chains. How to buy out a business partner or shareholder 6min read by nick green last updated 11 december 2023 businesses rarely stay the same over time, and the.