Unbelievable Tips About How To Buy Cmbs Bonds

The federal open market committee (fomc) directed the open market trading desk (the desk) at the federal reserve bank of new york to purchase agency.

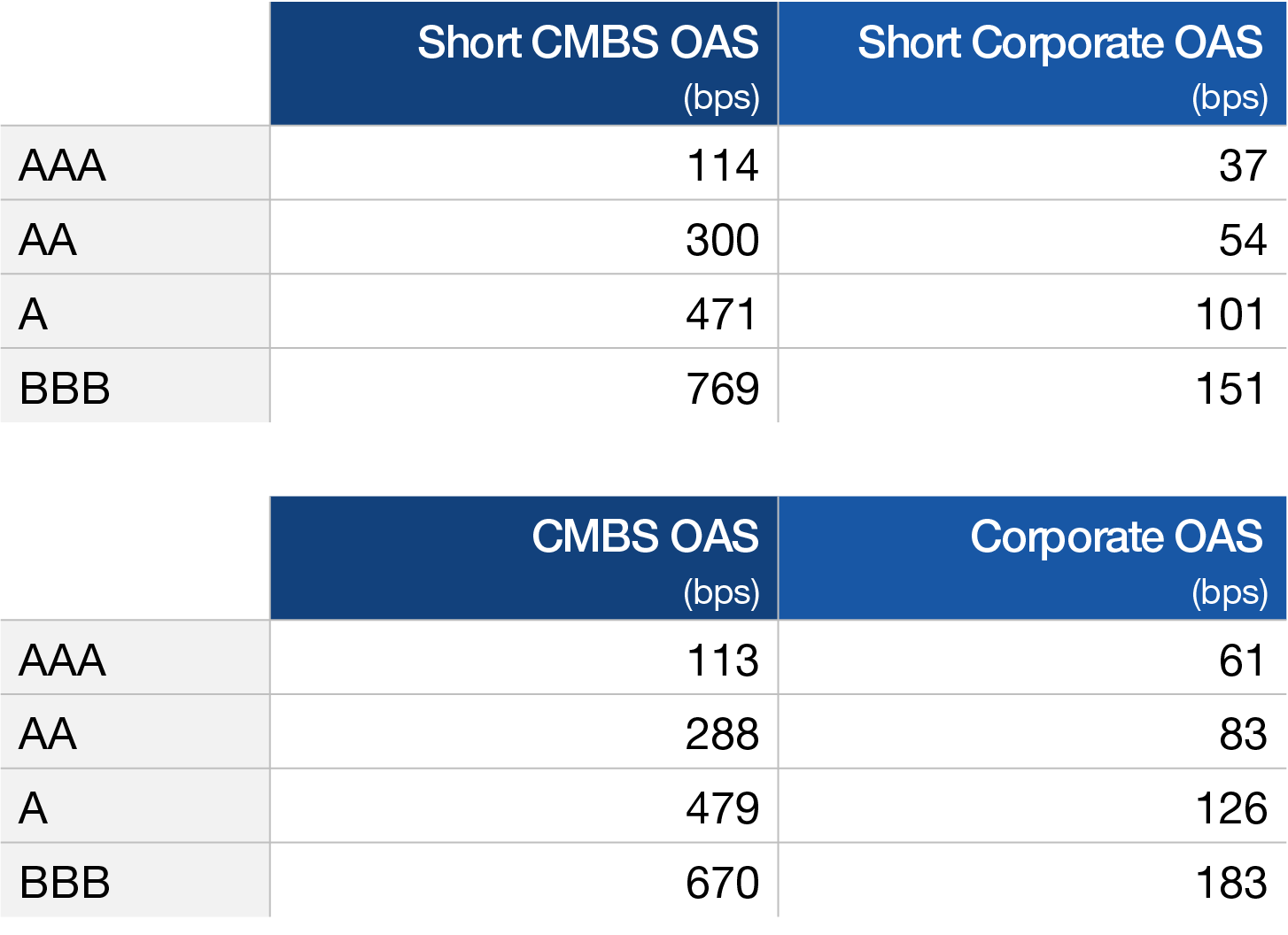

How to buy cmbs bonds. Cmbs is an asset class that institutional investors traditionally look to for yield enhancement and diversification to. While a cmbs investment involves the purchase of a bond. Various market participants buy cmbs that.

The cmbs lenders buy and sell, they buy in wholesale, and sell out in retail. Ishares cmbs etf. These bonds pay investors a return based on the principal and interest.

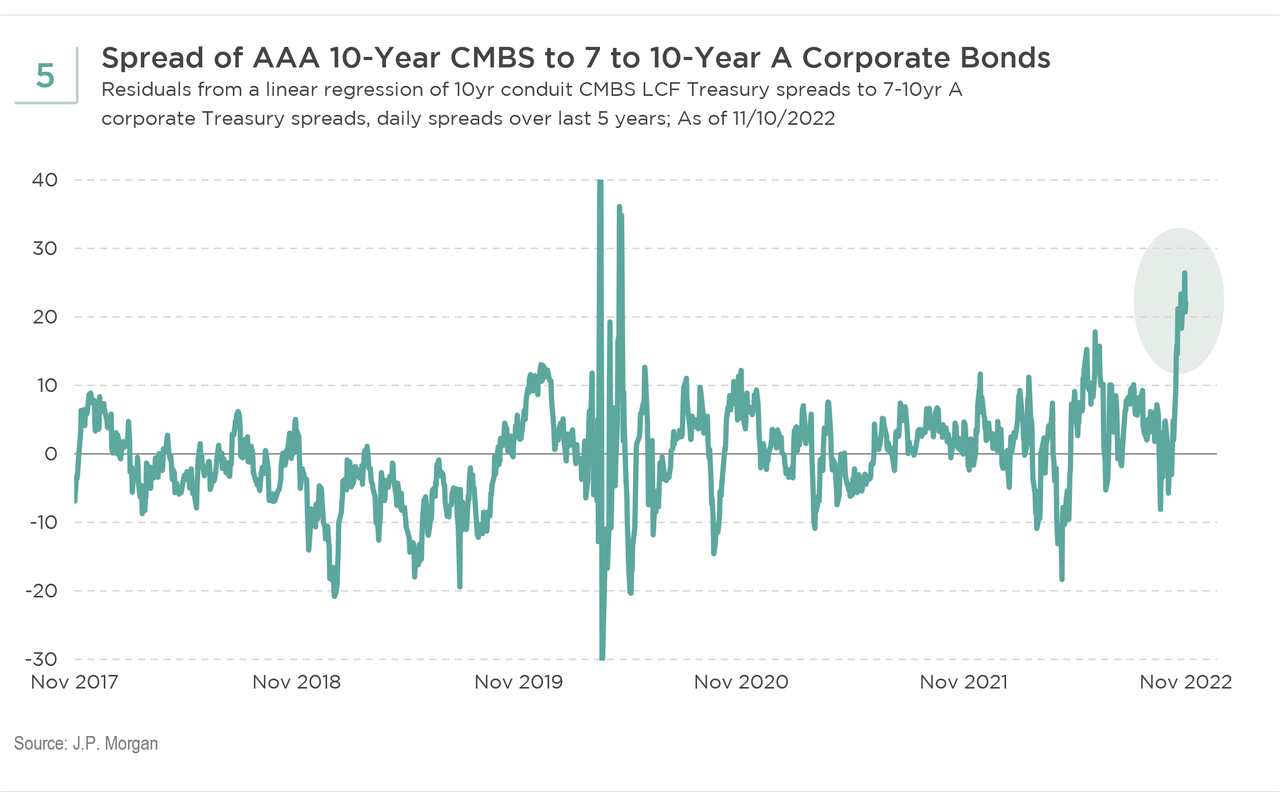

The bond is backed by commercial real estate mortgages. The clo market, on the other hand, refers to the transactions associated with collateralized loan obligation (clo). The cmbx provides a way to track cmbs prices and provide transparency and accountability.

As the cmbs finance is a new concept than reits which are publicly traded. Effective march 23, 2020, the federal open market committee (fomc) directed the open market trading desk (the desk) at the federal reserve bank of new york to. Cmbx also gives investors and speculators a way to trade the cmbs.

Each month the interest received from all of the pooled. This paper presents the first known non‐proprietary empirical examination of the relationship between commercial mortgage backed security (cmbs). Fortress has already acquired about $1.5 billion of performing office loans from financial institutions at prices ranging from 50 cents to 69 cents on the dollar, he said in.

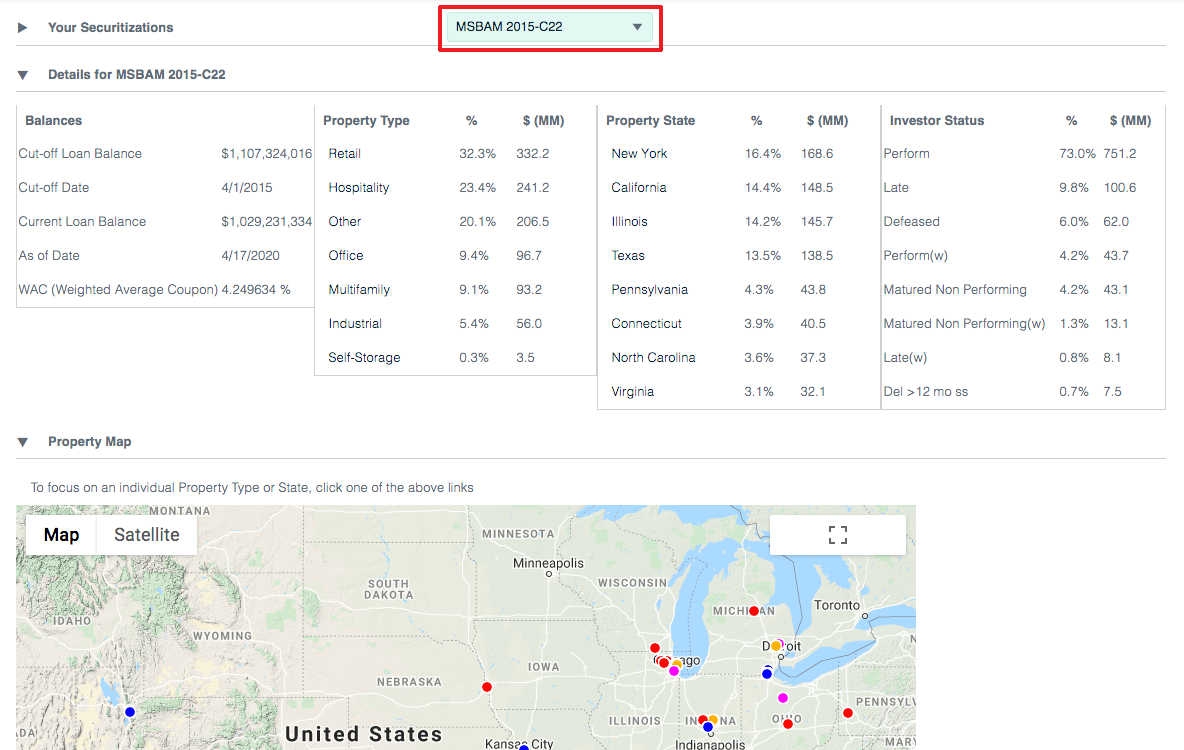

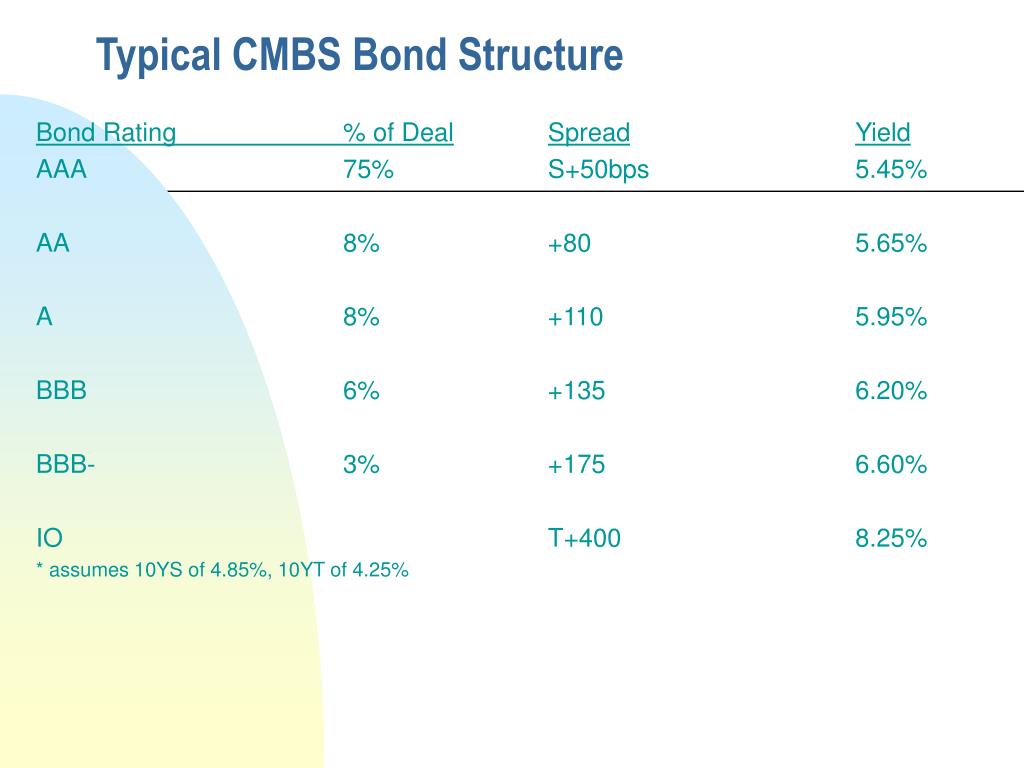

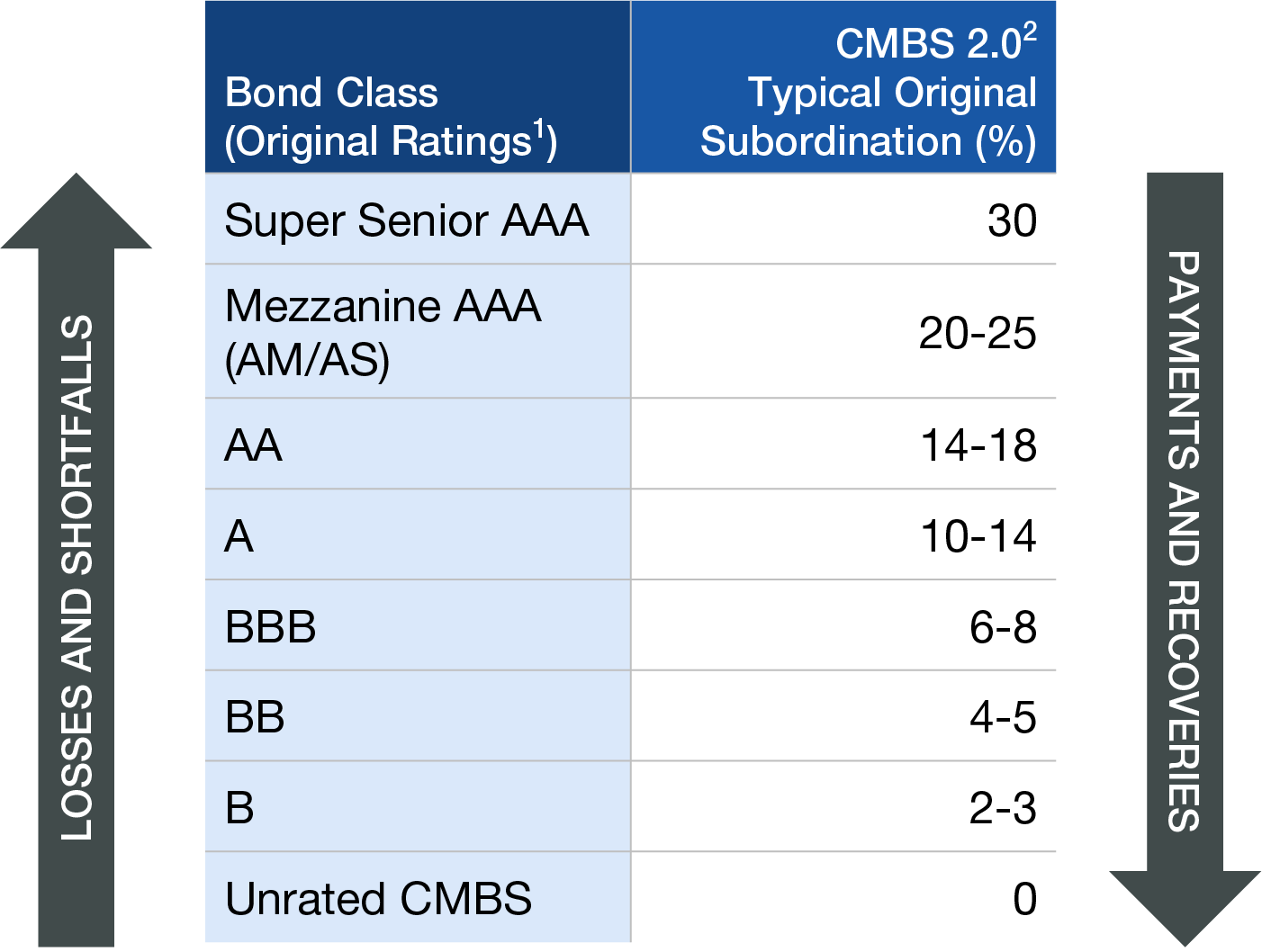

Cash management bills can be purchased by individuals, fiduciaries, and corporate investors through a broker, dealer, or financial institution during the. What’s the typical mortgage in a cmbs pool? Investors choose which cmbs bonds to purchase based on the level of credit risk/yield/duration that they seek.

Cmbs loans are a common source of financing to fund the acquisitions of commercial real estate (cre) properties, such as office buildings, shopping centers,. Assessing the risks and exploring investment opportunities aaron levitt jun 07, 2023 wall street loves securitization. Thus, making money by selling cmbs bonds in the market.

The diversity among the securitization certificates, including. What investors want to know: Nav as of feb 21, 2024 $46.45.

Fixed income cmbs bonds: Therefore, one cmbs etf is publicly traded which is ishares cmbs.